Term vs Whole Life Insurance — How I Got Confused Like Most People

United States, 2026. This is not advice. Just a real story about how confusion actually starts.

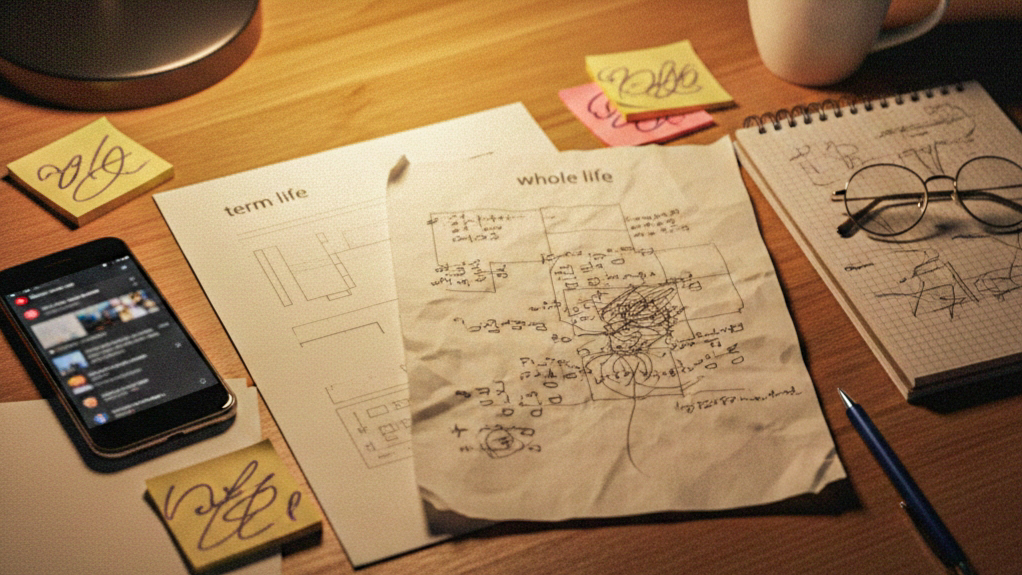

It started in a very normal way. Nothing dramatic. No emergency. Just one of those evenings where you’re lying down, phone in hand, scrolling without any real goal.

I was on YouTube, watching random stuff. A mix of shorts, long videos, podcasts. Finance videos kept appearing in between — not because I searched for them, but because that’s how the algorithm works.

One video mentioned life insurance. I didn’t click immediately. Then another video mentioned it again. Different creator. Different style. Same topic.

That’s when curiosity kicked in. Not fear — curiosity. I thought, “Let me just understand this properly.”

That decision — to “just understand” — is where things slowly started getting confusing.

One video explained term life insurance. It sounded simple. Affordable. Straightforward.

Another video explained whole life insurance. It sounded serious. Permanent. More complete.

At first, I thought the difference was obvious. Cheap vs expensive. Temporary vs permanent.

But the more videos I watched, the less confident I felt.

Not because the information was wrong — but because there was too much of it, coming from too many directions.

I started reading comments. That made it worse.

Some people were absolutely sure term life was enough. Others were equally sure that whole life was the only “responsible” choice.

What stood out wasn’t disagreement. It was confusion.

You could tell from the way people were asking questions. Short questions. Half-formed thoughts. A lot of “I’m not sure if I did the right thing.”

Watching all this, I realized something important: when people consume too many videos back-to-back, clarity doesn’t always increase. Sometimes it drops.

Every creator explains from a slightly different angle. Some focus on cost. Some focus on emotions. Some focus on long-term planning.

None of them are necessarily wrong. But when you’re new to the topic, your brain starts mixing everything together.

That’s exactly what happened to me.

I started asking myself questions that didn’t have simple answers. “What if I outlive the policy?” “What if permanent is safer?” “What if I choose wrong?”

These questions didn’t come from logic. They came from overload.

At some point, I stopped watching videos and just sat there thinking.

Why does the same topic make some people feel calm and others feel stressed?

That’s when I understood something very basic — insurance decisions don’t start with numbers. They start with mindset.

If you’re already feeling unsure, too much information can make things heavier instead of clearer.

Term life insurance began to feel “too simple.” Whole life insurance began to feel “too serious.”

And somewhere between those two feelings, confusion lives.

I noticed another pattern while reading discussions. People who had clarity usually talked about timing.

People who were confused talked about features.

Timing vs features. That difference matters more than it sounds.

At this stage, I wasn’t trying to choose anything. I just wanted to understand why this topic makes so many people second-guess themselves.

And that’s where this story really begins — not with policies, but with how our thinking changes when we’re exposed to too many opinions at once.

After that night, I didn’t rush into any decision. In fact, I didn’t even feel ready to decide. The confusion stayed with me for a while.

Over the next few days, the topic came up again — not on purpose, just naturally. Someone mentioned insurance in a casual conversation. Someone else talked about planning for the future.

What I noticed was interesting. The people talking weren’t careless. They weren’t irresponsible. Most of them were simply trying to make sense of things while juggling real life.

Rent. Mortgage. Kids. Savings. Unexpected expenses.

Insurance wasn’t the center of their life. It was just one more decision competing for mental space.

How real-life situations quietly shape the choice

When you step away from videos and comments and look at real situations, the difference between term and whole life starts to feel less dramatic — and more practical.

For example, someone early in their career, still building savings, often values flexibility more than permanence.

Monthly breathing room matters. Having the option to adjust matters.

In that phase of life, term life doesn’t feel like a compromise. It feels like a tool.

On the other hand, someone much later in life, with stable income and fewer obligations, might see value in something permanent.

Same products. Different moments.

That’s the part that gets lost when everything is explained in one-size-fits-all language.

Why term life slowly started making more sense

The more I thought about it, the more I realized term life insurance is designed for uncertainty.

It exists for the years when things are still in motion — careers evolving, families growing, responsibilities changing.

Term life doesn’t try to lock the future. It just supports the present.

And there’s something comforting about that, once you stop expecting it to be something else.

Many people dismiss term life because it “ends.”

But most financial risks also end — loans get paid, kids grow up, savings accumulate.

In that sense, term life often ends when it’s no longer needed.

Why whole life feels safer — and heavier

Whole life insurance offers certainty. And certainty feels good.

Knowing something won’t expire removes one question from the future.

But certainty has a cost — not just financially, but mentally.

A higher premium is a long-term commitment. It quietly shapes how flexible your budget can be.

For some people, that tradeoff is worth it.

For others, it becomes noticeable only after a few years, when priorities shift.

That’s where mixed feelings often come from — not from a bad product, but from a mismatch in timing.

Seeing the difference side by side

Thinking in stories helped more than thinking in features. When I imagined real people in real situations, the contrast became clearer.

| Life Situation | Term Life Tends to Feel Like | Whole Life Tends to Feel Like |

|---|---|---|

| Early career, growing family | Supportive and flexible | Heavy commitment |

| Later stage, stable finances | Limited | Reassuring |

| Uncertain future plans | Adaptable | Restrictive |

None of these are rules. They’re just patterns that show up again and again.

Why confusion is actually normal

Looking back, the confusion I felt didn’t mean I was uninformed. It meant I was processing something complex.

Insurance decisions sit at the intersection of money, emotion, and responsibility.

It’s normal to hesitate. It’s normal to feel unsure.

The mistake isn’t confusion. The mistake is rushing through it.

Why insurance matters, in the end

When everything settles, insurance isn’t about products or terminology.

It’s about reducing pressure during moments when life already feels heavy.

It’s about giving the people around you time and space instead of forcing immediate financial decisions.

Whether that comes from term life or whole life depends on where you are, not on what sounds better.

Final thoughts

After sitting with this topic for a while, one thing became clear.

There is no universally “right” choice — only a choice that fits your current reality.

Term life and whole life are tools for different phases, not competing sides.

Understanding that — slowly, without pressure — is often more valuable than any quick answer.