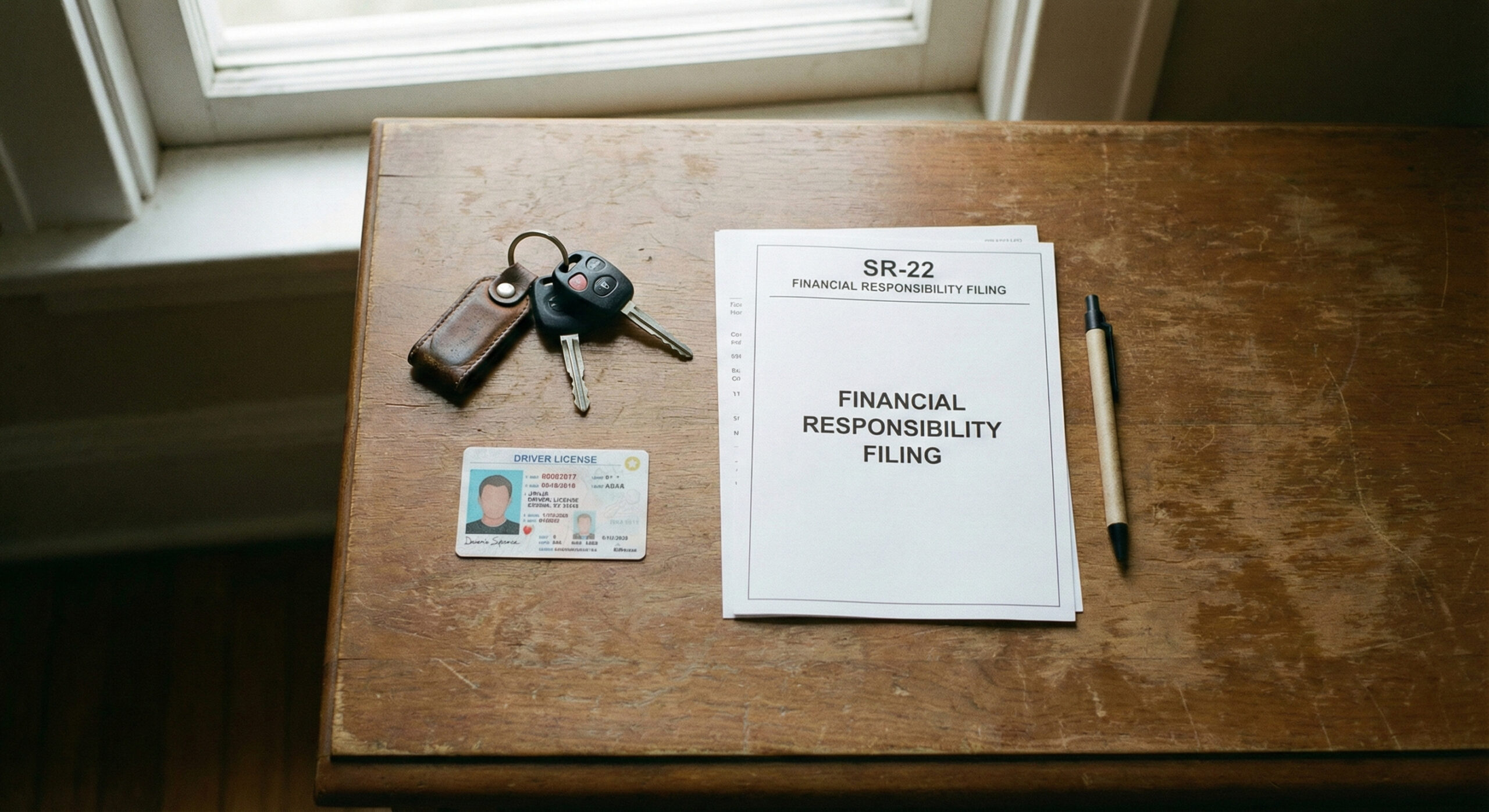

Non-Owner SR-22 Insurance: How It Works & Why You May Need It

Clear, practical guidance on non-owner SR-22 filings — who needs it, how to get it fast, real cost expectations, and smart ways to avoid common mistakes.

Explore Top Guides

I wasn’t expecting to need an SR-22. I’d borrowed a friend’s car for a weekend and a bad decision led to a ticket that changed my priorities overnight. When the court said I needed an SR-22, I panicked — not because of the form itself, but because everything around it felt rushed, expensive, and confusing.

That experience taught me two things: first, SR-22 filings are common, and second, a non-owner SR-22 exists exactly for people who drive but don’t own a vehicle. This guide explains what a non-owner SR-22 is, who needs one, how much it costs, how to purchase quickly and affordably, and practical steps to reduce long-term insurance pain.

What Is a Non-Owner SR-22?

In short: an SR-22 is a certificate your insurance company files with the state to prove you carry the minimum required liability coverage. A non-owner SR-22 is a specific SR-22 filed for drivers who do not own a vehicle but still need to prove financial responsibility — often after DUI/DWI convictions, multiple at-fault accidents, or certain serious moving violations.

Non-owner SR-22s are meant to cover situations where you occasionally borrow or rent cars. They don’t provide collision or comprehensive coverage for vehicles you don’t own — they simply certify liability insurance so the state or court knows you’re insured when behind the wheel.

Important distinction: a non-owner SR-22 does not insure any car. If you borrow someone’s car and want damage protection, you still need the vehicle owner’s insurance or a separate rental/loaner coverage.

Who Typically Needs a Non-Owner SR-22?

States and courts vary, but these are the most common triggers:

- DUI / DWI conviction — one of the most common reasons an SR-22 is required.

- Serious moving violations — reckless driving, hit-and-run, driving without insurance.

- Multiple at-fault accidents in a short period.

- Failure to maintain insurance previously — lapsed or cancelled policy.

If you don’t own a car — think rideshare drivers who don’t own the vehicle they drive, college students, or people who borrow cars — the non-owner SR-22 is the state’s way of making sure you remain financially responsible even when you don’t have your own policy.

Note: some states will not accept a non-owner SR-22 for certain offenses (like major DUI repeat offenses). Always check state rules or ask a licensed agent for your state-specific guidance.

How to Get a Non-Owner SR-22 (Step-by-Step)

The process is straightforward if you know what to expect. Here’s the simple path I recommend — efficient, no drama.

- Confirm state requirements: Rules and minimum liability limits vary. Call the DMV or check its website for exact thresholds and any waiting periods.

- Contact insurers that offer non-owner SR-22s: Not every insurer provides them. Start with national carriers and local agents who specialize in high-risk filings.

- Provide driver info: Name, address, driver’s license, and details about the court order or ticket requiring the SR-22.

- Choose your effective date: Ask for same-day filing if the court deadline is near. Many carriers will file electronically within 24 hours.

- Pay the SR-22 filing fee: Fees usually range $15–$50 plus any down payment on the policy; some carriers bundle the filing with the first premium.

- Verify the filing: Request a copy of the filed SR-22. Keep proof — you’ll often need to show it to the court or to your employer (for commercial drivers).

Quick tip: if you expect to drive occasionally, look for a non-owner SR-22 that allows temporary vehicle use without automatically converting you into a full owner policy — this keeps costs down.

How Much Does a Non-Owner SR-22 Cost?

There’s no single answer, but here’s a realistic range and the main factors that decide your price.

Typical cost elements:

- SR-22 filing fee: $15–$50 (one-time, state or insurer fee).

- Policy premium (non-owner liability): $200–$800 per year depending on state, driving record, and age.

- High-risk surcharge: If you’re classified high-risk, expect a higher premium; some drivers pay $1,000+ annually in extreme cases.

For many people, a non-owner SR-22 adds $200–$600 to what they’d otherwise pay annually for minimal coverage. But remember — the cost of driving uninsured or without required filings is far higher when fines, license suspension, and re-instatement fees kick in.

Factors that raise or lower cost include your age, state, prior violations, and whether you have recent claims or DUIs. Young drivers and repeat offenders will see the steepest increases.

Smart Ways to Reduce SR-22 Non-Owner Insurance Costs

An SR-22 filing doesn’t automatically mean your insurance needs to stay expensive. With the right strategy, you can bring the cost down significantly within months. These techniques are routinely recommended by high-risk insurance specialists and can genuinely save you hundreds of dollars during your SR-22 period.

1. Stay violation-free during the filing period

This is the number one money-saver. Every month you drive without tickets, accidents, or insurance lapses, your “risk score” improves quietly in the background. Carriers reevaluate your profile annually, and many offer automatic premium drops after 6–12 months of clean driving.

2. Complete state-approved defensive driving courses

These programs help lower your perceived risk. Some states allow discounts up to 10–15% when you submit a completion certificate. The classes are inexpensive, often online, and can be completed in a single afternoon.

3. Ask for “pay-in-full” or autopay discounts

Many insurers offer small but noticeable savings if you pay the entire six-month premium in advance or use automatic payments. Even 3–5% discounts add up during SR-22 periods.

4. Compare at least three SR-22 specialist carriers

Not all insurers treat high-risk drivers the same. Some heavily penalize DUIs; others penalize uninsured lapses more. Getting quotes from SR-22 specialists gives you better pricing because these companies focus on high-risk coverage.

5. Keep a stable address and employment history

Insurers consider stability a sign of responsibility. Even simple things like keeping the same mailing address or job for six months can result in lower premiums during policy renewals.

6. Avoid owning a car during your SR-22 period

Ownership triggers a full-car insurance policy with higher liability requirements. If you don’t need a vehicle daily, staying on a non-owner SR-22 is far cheaper and easier to manage.

7. Check eligibility for reduced filing periods

Some states shorten SR-22 duration for drivers who complete safety courses, remain violation-free, or demonstrate consistent insurance coverage. It’s worth asking your DMV.

These strategies don’t just save money — they help rebuild your driving record so that once the SR-22 requirement ends, your premium returns to normal much faster.

Common Mistakes to Avoid With Non-Owner SR-22 Policies

SR-22 filings are strict, and even small missteps can restart your required filing period or lead to immediate license suspension. Here are the pitfalls to avoid:

- Letting your policy lapse: The state is notified instantly if your SR-22 cancels — your clock resets to day one.

- Borrowing a car you use frequently: A non-owner policy is for occasional use only. Driving the same car often may require a full liability policy.

- Not updating your address: Moves must be reported to both your insurer and the DMV. Incorrect addresses cause filings to fail.

- Assuming all states have the same rules: SR-22 requirements vary widely. If you move, confirm rules in the new state.

- Trying to hide violations: Insurance databases track everything. Always disclose required information upfront.

Avoiding these mistakes keeps your SR-22 period as short and affordable as possible.

Important Rules Every SR-22 Driver Should Know

SR-22 filings come with obligations that many drivers don’t fully understand. Staying aware of these small but critical rules can help you avoid legal issues:

- Your insurer reports everything directly to the state: You don’t submit SR-22 documents yourself.

- Coverage must be continuous: Even a one-day cancellation triggers penalties.

- You must carry proof of insurance: Courts, employers, and rental companies may require it.

- You may need higher liability limits: Some states mandate higher minimums for SR-22 drivers.

- SR-22 is not insurance: It’s simply a certificate proving you carry insurance.

Once your required period ends — typically 3 years — your insurer files an SR-26 to notify the state your obligation is complete.

Frequently Asked Questions

Does a non-owner SR-22 cover rental cars?

Yes, but only for liability. It doesn’t cover damage to the rental car itself. Rental agencies usually require their own damage waivers for that.

How long do I need to maintain an SR-22?

Most states require 3 years, but it can range from 1–5 years depending on the severity of the violation.

Can I switch insurers during my SR-22 period?

Yes, but your new insurer must file a fresh SR-22 immediately. Never cancel your old policy before the new filing is confirmed.

What happens if I move to a different state?

Most states require you to maintain the SR-22 for the original state that ordered it, even if you move. Your insurer can file across states in most cases.

Is a non-owner SR-22 cheaper than a standard SR-22?

Almost always. Because you don’t own a vehicle and the insurer doesn’t have to cover physical damage, non-owner SR-22 policies cost significantly less.

About the Author

InsureLyric creates easy-to-understand, human-focused guides to help U.S. readers navigate complex insurance decisions with confidence.

Visit our Contact page with any questions, or read our Terms and Privacy Policy.

*This content is for educational purposes only. Insurance rules vary by state and provider. Always review your official policy documents.*