Why Insurance Claims Get Denied (And How to Avoid Common Mistakes)

Claim denial is one of the most frustrating experiences policyholders face. This guide explains why insurance claims are denied across home, auto, health, and business policies — and what you can do to reduce the risk of rejection before and after filing a claim.

Start Reading

Why insurance claim denials happen more often than people expect

Insurance is designed to provide financial protection during unexpected events, yet claim denials are far more common than most policyholders realize. This disconnect often leads to frustration, confusion, and mistrust in insurers. In reality, most denied insurance claims are not the result of bad faith. They are usually caused by misunderstandings about policy terms, coverage limits, and claim requirements.

One major reason claims get denied is that insurance policies are contracts, not guarantees. Coverage only applies when specific conditions are met. If a loss falls outside those conditions, insurers are obligated to deny the claim regardless of how reasonable the situation feels.

Another factor is timing. Insurance policies impose strict deadlines for reporting losses, submitting documentation, and cooperating with investigations. Missing a deadline — even unintentionally — can jeopardize an otherwise valid claim.

Documentation issues are also a leading cause of claim denials. Insurers rely on proof to verify losses. Incomplete forms, missing receipts, inconsistent statements, or lack of supporting evidence can result in delayed or denied claims.

Policy exclusions are another frequent problem. Every insurance policy lists situations it does not cover. These exclusions may involve maintenance issues, wear and tear, certain natural disasters, or specific types of liability. Policyholders often discover exclusions only after filing a claim.

Claim denials can also occur due to misrepresentation. If information provided during application differs materially from the actual risk, insurers may deny claims related to that discrepancy. Even unintentional errors can create problems.

Fraud prevention plays a role as well. Insurers are required to investigate suspicious claims. While this protects the system from abuse, it can slow down or complicate legitimate claims. Delays sometimes feel like denials when the process is not clearly explained.

Understanding these root causes helps shift expectations. Claim denials are rarely personal. They are the outcome of contract language, documentation standards, and regulatory obligations.

When policyholders understand how insurers evaluate claims, they are better positioned to avoid mistakes that lead to unnecessary denials.

The most common insurance claim denial reasons across all policy types

While denial reasons vary by policy, certain issues appear repeatedly across auto, home, health, life, and business insurance. Recognizing these patterns can dramatically improve claim success rates.

One of the most frequent reasons is filing a claim for something that is not covered. Coverage gaps often exist due to exclusions, sub-limits, or endorsement requirements. What feels like a covered loss may not meet the policy’s definition of a covered event.

Another major cause is failure to mitigate damage. Most policies require policyholders to take reasonable steps to prevent further loss. Ignoring temporary repairs or allowing damage to worsen can result in partial or full denial.

Late reporting is a serious issue. Delays can prevent insurers from properly investigating claims. Even when damage is obvious, waiting too long to report it may violate policy conditions.

Inconsistencies between statements, records, and evidence also raise red flags. Small discrepancies can undermine credibility and lead to extended investigations or denial.

Claims may also be denied if required endorsements were not purchased. Flood, earthquake, cyber incidents, and certain liabilities often require separate coverage. Standard policies do not automatically include them.

Deductibles and coverage limits play a role as well. Some claims are technically approved but result in no payout because losses fall below deductibles or exceed policy limits. This can feel like a denial even when coverage technically exists.

Finally, lack of cooperation can harm a claim. Policies require policyholders to provide information and participate in investigations. Refusing access or failing to respond can void coverage.

Understanding these common denial triggers allows policyholders to approach claims more strategically and with fewer surprises.

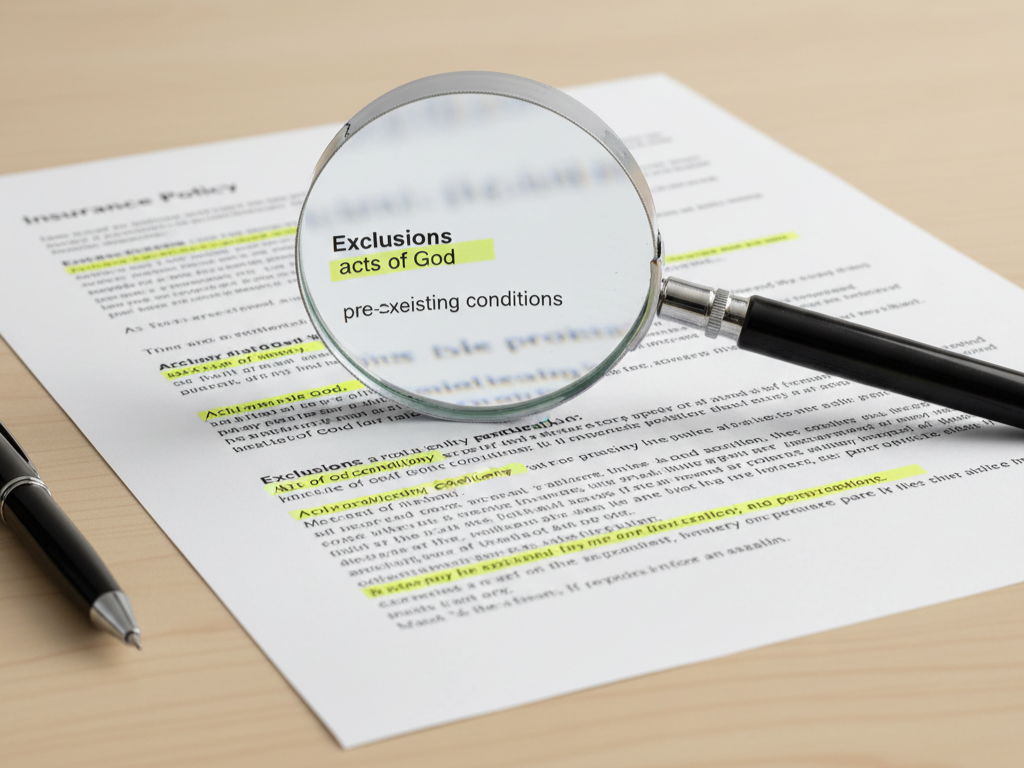

Policy exclusions, fine print, and coverage limits that derail claims

Policy exclusions are one of the most common and least understood reasons insurance claims get denied. Every insurance policy is built around what is covered and, equally important, what is not. These exclusions are not hidden tricks — they are fundamental to how insurance pricing and risk management work.

Exclusions exist because some risks are either predictable, preventable, or too severe to be pooled at standard premiums. Wear and tear, poor maintenance, intentional acts, and certain natural disasters are frequent examples. When losses fall into these categories, insurers are contractually required to deny coverage.

Coverage limits create another point of confusion. Even when a claim is approved, payouts are capped by the policy’s stated limits. Losses that exceed those limits become the policyholder’s responsibility. Many people interpret this shortfall as a denial when it is actually a limit issue.

Sub-limits add another layer. Certain items or loss types may have lower maximum payouts than the overall policy limit. Jewelry, electronics, business equipment, and specialized property are common examples.

Deductibles also affect perception. If the cost of damage falls below the deductible, the insurer technically approves the claim but issues no payment. This often feels like a rejection, even though the policy is functioning as written.

Endorsements play a critical role. Many important coverages are optional and must be added separately. Flood, earthquake, cyber incidents, professional liability, and certain business risks are rarely included by default.

Claims are frequently denied simply because the appropriate endorsement was never purchased. This highlights the importance of reviewing policies regularly, especially when circumstances change.

The fine print matters, but understanding it does not require legal training. Paying attention to exclusions, limits, and endorsements before a loss occurs is the most effective way to avoid unpleasant surprises later.

Policyholders who treat insurance as a living document — not a one-time purchase — experience far fewer claim denials over time.

How to reduce the risk of insurance claim denial before and after filing

The best way to avoid claim denial is to start before a loss ever happens. Prevention, preparation, and documentation are more powerful than appeals.

Begin by reviewing your policies annually. Life changes, business growth, new purchases, and regulatory shifts can all create coverage gaps. Updating limits and endorsements keeps protection aligned with reality.

Documentation is critical. Maintain records of purchases, maintenance, upgrades, contracts, and communications. Photos, receipts, and logs provide evidence that supports claims when disputes arise.

When a loss occurs, act quickly but carefully. Notify the insurer promptly, even if damage seems minor. Delayed reporting is one of the easiest ways to jeopardize coverage.

Mitigate further damage when required. Temporary repairs, safety measures, and reasonable precautions demonstrate compliance with policy conditions. Failure to do so can weaken a claim.

Be consistent and accurate. Provide truthful information and avoid speculation. Inconsistencies, even small ones, can trigger extended investigations or denial.

Communicate in writing whenever possible. Emails and claim portals create records of what was reported, when it was reported, and how the insurer responded.

If a claim is denied, request a written explanation. Denials must reference specific policy language. Understanding the reason determines whether an appeal is appropriate.

Appeals should be evidence-based, not emotional. Additional documentation, expert opinions, or clarification of facts can sometimes reverse decisions.

Ultimately, successful claims are built on preparation. Policyholders who understand their coverage, maintain records, and follow procedures experience fewer denials and faster resolutions.

This article is for informational purposes only and does not constitute legal, financial, or insurance advice. Coverage terms, exclusions, and claim procedures vary by policy and state. Always consult your insurer or a licensed professional regarding your specific situation.

The InsureLyric editorial team focuses on explaining insurance concepts in clear, practical language for U.S. readers, helping policyholders make informed decisions and avoid costly mistakes.

Last updated: December 2025