How to File an Insurance Claim (Step-by-Step Guide with Templates & Scripts)

Updated: November 2025 · Practical guide for everyday policyholders

Make your next insurance claim clear, confident, and stress-free.

This guide walks you through how insurance claims really work, with plain-English steps, email templates, and call scripts you can use today.

Explore Top Guides →

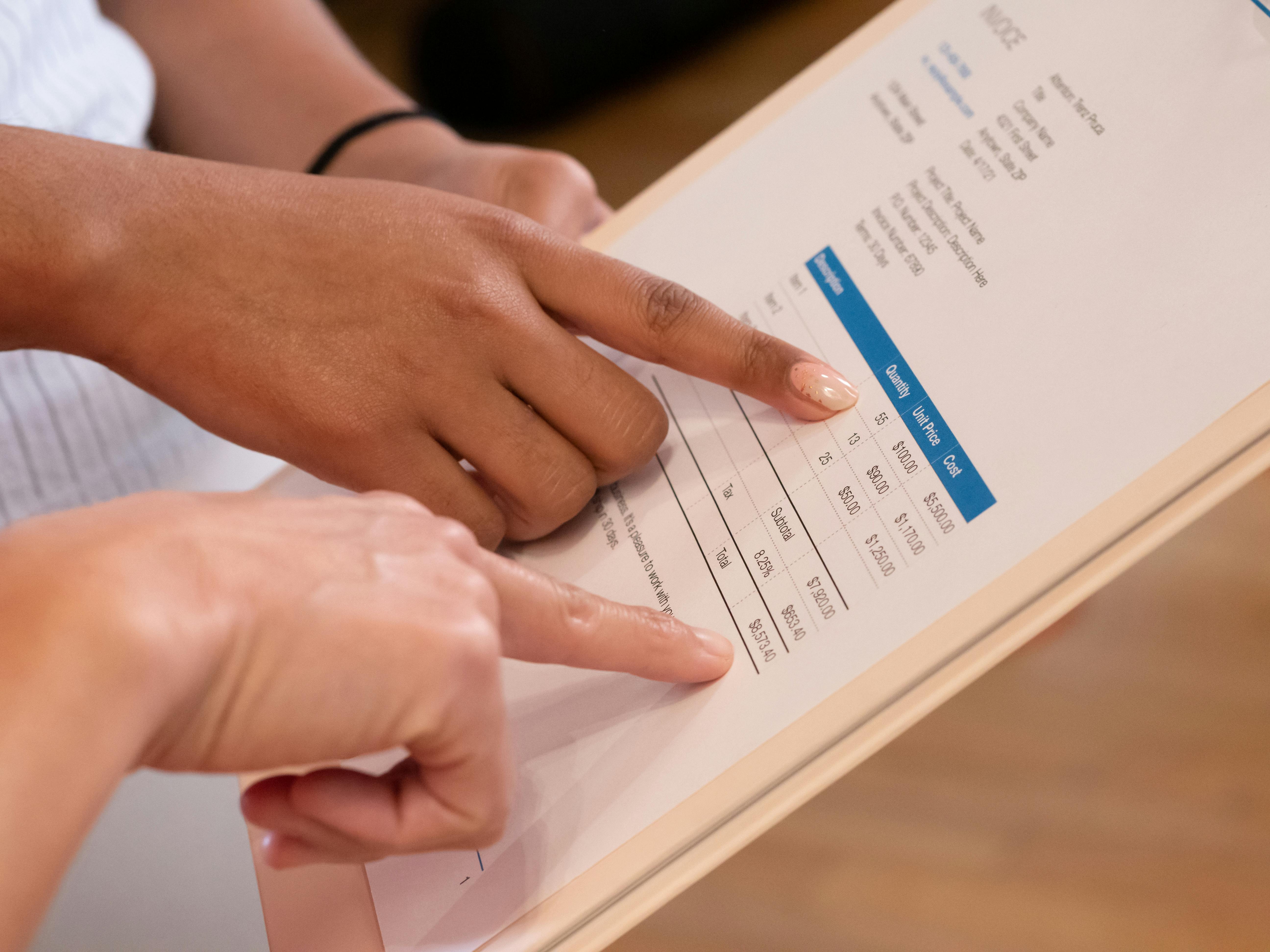

Caption: woman filling an insurance claim form at her desk.

Filing an insurance claim usually happens on a stressful day — after an accident, a hospital visit, or damage to your home. In that moment, the last thing you want is confusing paperwork and long calls. The good news is that once you understand the process, most claims follow the same simple pattern.

In this guide, we’ll walk through how to file an insurance claim for auto, health, home, and life policies in a clear, practical way. You’ll see exactly what documents you need, what to say when you call, and how to avoid the mistakes that cause delays and denials.

1. What is an insurance claim?

An insurance claim is simply a request you send to your insurance company asking them to pay for a loss covered under your policy. That loss might be a car accident, a hospital bill, water damage in your home, or the death of a loved one under a life insurance policy.

Once you file a claim, the company checks three things:

- Is this person covered under a valid policy?

- Is the event they’re claiming covered under the policy terms?

- Are the documents and details complete and accurate?

If the answer is “yes” to all three, the claim is usually approved and paid. If any part is unclear or missing, the company may delay or deny the claim — which is why filing properly matters so much.

2. Types of insurance claims (with real-life context)

Health insurance claims

Health claims cover things like doctor visits, emergency room care, surgery, lab tests, and prescription medicines. Some claims are handled directly between the hospital and the insurer (often called “cashless”), while others require you to pay first and ask for reimbursement later.

Auto insurance claims

Auto claims follow collisions, theft, vandalism, or weather-related damage. You may be asked for photos, a police report, driver details, and repair estimates. Quick reporting is important here — many policies require notification within 24–72 hours.

Homeowners or renters insurance claims

These claims relate to damage or loss in and around your home — such as fire, storm damage, water leaks, or burglary. Your insurer may send an adjuster to inspect the property before approving repairs or replacement.

Life insurance claims

Life claims are typically filed by the beneficiary of the policy after the policyholder passes away. The insurer will review the policy history, the cause of death, and submitted documents (like a death certificate) before releasing the payout.

3. Step-by-step: how to file an insurance claim correctly

Whether you’re dealing with a car, hospital stay, broken pipe, or life policy, most claims follow the same basic steps. Here’s a simple, repeatable process you can use.

Step 1: Collect your documents

Start by gathering everything that proves what happened and how much it cost. Depending on the claim, that might include:

- Your policy number and ID card

- Photos or videos of the damage

- Hospital or doctor bills and reports

- Repair estimates or invoices

- Police report or incident report if applicable

- Death certificate for life insurance claims

Keep all these documents in one folder — both physically and digitally (scans or photos). If the company asks for something twice, you’ll have it ready.

Step 2: Notify your insurer as soon as possible

Next, call the number on your insurance card or visit the insurer’s website/app to report the incident. Many policies require “prompt notice,” and some put strict deadlines on claims, especially for auto and property damage.

When you call, write down:

- The date and time of the call

- The name of the person you spoke with

- Any claim or reference number they give you

Step 3: Fill out the claim form (carefully)

The claim form may be online or a PDF. Take your time. Small errors — like dates, misspelled names, or missing details — are one of the biggest reasons for delays.

Make sure you clearly describe:

- What happened

- Where and when it happened

- Who was involved

- What was damaged or what treatment was done

Step 4: Submit everything and keep a copy

Send the claim form and documents using the method your insurer prefers — website upload, email, app, or physical mail. Always keep:

- A copy of the form you submitted

- Scans or photos of all attachments

- The date you sent them

Step 5: Follow up with your claims adjuster

After submission, your claim is usually assigned to a “claims adjuster” or “claims specialist.” Their job is to review what you sent, ask for anything missing, and recommend approval or denial.

Don’t hesitate to follow up. Polite, consistent follow-ups show that you’re serious and help catch issues early.

4. Email templates and phone scripts you can reuse

You don’t have to write perfect messages. These simple templates are more than enough to get a professional response from your insurer.

Email template: submitting a new claim

Subject: Insurance Claim Submission – Policy [Policy Number] Hello, I am submitting a claim under policy number [Policy Number] for an incident that occurred on [Date] involving [brief description – e.g., car accident / hospital visit / water damage]. I have attached the relevant documents, including [list main documents]. Please confirm that you received this claim and let me know if any additional information is required. Thank you, [Your Full Name] [Phone Number] [Email Address]

Phone script: checking your claim status

Hi, my name is [Your Name]. I’m calling about an insurance claim I submitted on [Date]. My policy number is [Policy Number], and my claim or reference number is [Claim Number, if you have it]. Could you please tell me the current status of my claim and let me know if you need any additional documents from me? Thank you.

Email template: sending missing documents

Subject: Additional Documents for Claim – [Claim Number / Policy Number] Hello, This email is in reference to my insurance claim under policy number [Policy Number] and claim number [Claim Number]. As requested, I am attaching the additional documents: - [Document 1] - [Document 2] - [Document 3] Please confirm that these documents have been received and added to my claim. Best regards, [Your Full Name] [Phone Number]

5. Why insurance claims get denied (and how to avoid it)

Most denials are not personal — they are usually about missing information, timing, or policy rules. Knowing the common reasons can help you stay ahead of them.

Common reasons for denial

- The incident is not covered under the policy (exclusion)

- The claim was filed too late

- Documents are incomplete or unclear

- Details on the form don’t match reports or invoices

- The insurer suspects misrepresentation or fraud

How to reduce your chances of denial

- Read your policy’s coverage and exclusions section at least once

- File the claim as soon as reasonably possible

- Send clear, legible copies of all documents

- Keep your story consistent across forms, calls, and reports

- Ask the company to explain any unclear instructions in writing

6. Frequently asked questions about insurance claims

How long does an insurance claim usually take?

Can I appeal if my claim is denied?

Do I always need a lawyer to file a claim?

7. Final checklist before you submit your claim

- Have you read the relevant part of your policy at least once?

- Do you have all bills, photos, and reports in one place?

- Is the claim form complete and consistent with your documents?

- Did you note the date you reported the incident?

- Have you set a reminder to follow up in a few days?

Still unsure about your claim? You can always reach out through our Contact page and get guidance tailored to your situation.